The 5G Race: USA vs China - A Deep Dive into Global Technology Leadership

The battle for 5G supremacy represents one of the most significant technological competitions of the 21st century. This race extends far beyond telecommunications, encompassing national security, economic dominance, and geopolitical influence. Two superpowers stand at the center of this competition: China and the United States, each pursuing dramatically different strategies to achieve 5G leadership.

The Infrastructure Deployment Battle

The most visible aspect of the 5G race lies in infrastructure deployment, where the numbers tell a compelling story of Chinese dominance. China has built an extraordinary 4.19 million 5G base stations by 2024, compared to the United States' 270,000 stations. This represents a staggering 15.5 times more infrastructure deployment, showcasing China's commitment to dense, comprehensive coverage.

5G Base Stations Deployment comparison between China and USA showing China's massive infrastructure lead

The rapid pace of Chinese deployment becomes even more apparent when examining the timeline. Starting from roughly equal positions in 2019, China accelerated dramatically, adding over 2.7 million base stations in just three years while the US added approximately 210,000. By 2021, China already accounted for 70% of all global 5G base stations, a position it has maintained and strengthened.

This infrastructure advantage translates directly into subscriber numbers. China boasts 1.18 billion 5G subscribers compared to 182 million in the United States, representing a 6.5 to 1 advantage. However, the story becomes more nuanced when considering coverage breadth versus density. While China focuses on dense urban coverage, the United States has achieved broader geographic distribution, covering 503 cities compared to China's 356.

Investment and Financial Commitment

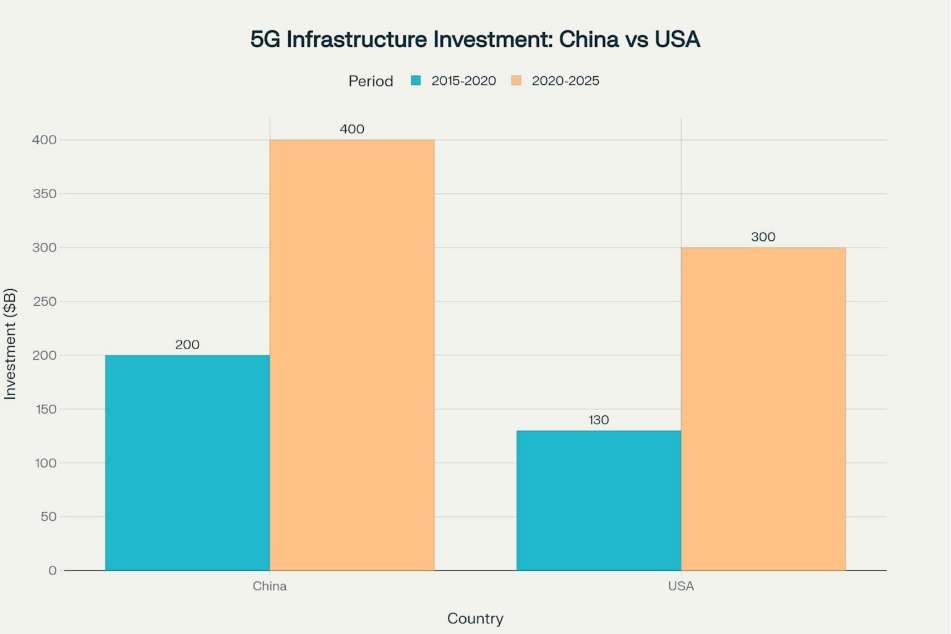

The financial scale of the 5G race reveals the enormous stakes involved. China has committed approximately $600 billion to 5G infrastructure development between 2015 and 2025, compared to the United States' $430 billion commitment. This $170 billion investment gap represents more than just spending differences; it reflects fundamentally different approaches to technology development.

5G Infrastructure Investment comparison showing China's higher investment in both periods

China's investment strategy shows front loading, with massive upfront commitments designed to establish early dominance. The planned investment for 2020 to 2025 reaches $400 billion, demonstrating sustained commitment to maintaining technological leadership. Meanwhile, US investment has been more measured, relying on private sector efficiency and market driven deployment strategies.

The investment patterns reveal strategic priorities. China treats 5G as critical national infrastructure, similar to highways or power grids, justifying massive state coordinated spending. The United States approach emphasizes market competition and private sector innovation, resulting in more targeted but smaller scale investments.

Patent Leadership and Innovation

The intellectual property landscape of 5G technology shows intense competition between the two nations. China holds 18,728 patent families representing 39.9% of global 5G standard essential patents, while the United States controls 16,206 families or 34.6% of the total.

5G Standard Essential Patents distribution showing China and USA dominating the patent landscape

This patent distribution has profound implications for global technology standards and licensing revenues. Chinese companies, led by Huawei with 6,583 patent families representing 14% of the global total, have established themselves as essential contributors to 5G technology development. Seven of the top 15 global patent applicants are Chinese companies, compared to two each from the United States, Japan, Europe, and South Korea.

The patent advantage provides China with significant leverage in international negotiations and standard setting processes. Countries and companies implementing 5G networks must often license technology from Chinese patent holders, creating both revenue streams and potential points of technological influence.

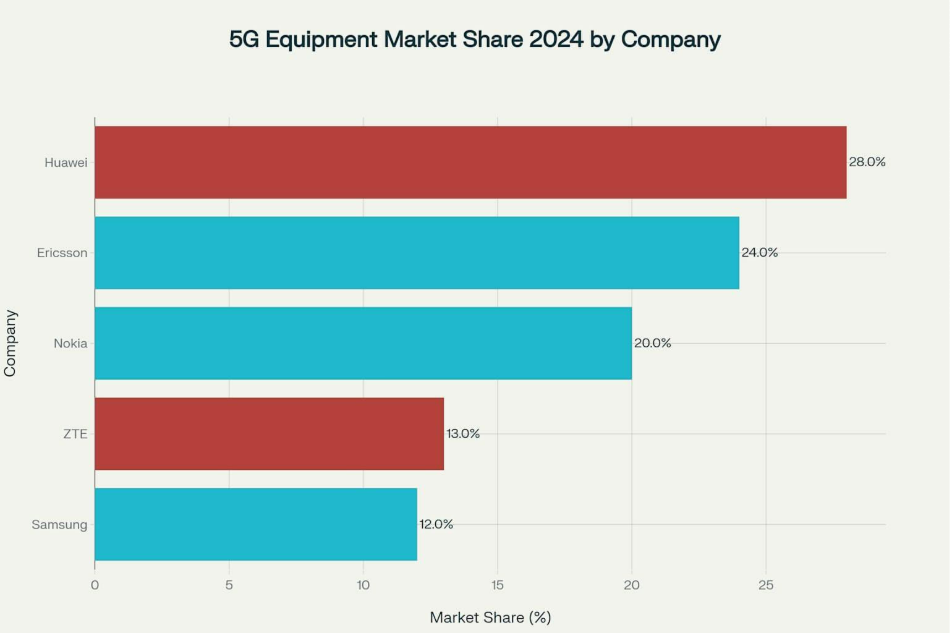

Equipment Market Dominance

Chinese companies have achieved remarkable success in the global 5G equipment market, controlling 41% of total market share through Huawei and ZTE combined. Huawei alone maintains 28% of the global market despite facing significant international restrictions, while ZTE holds 13%.

5G Equipment Market Share showing Chinese companies' dominance in the global 5G equipment market

This equipment dominance creates strategic advantages beyond immediate revenues. Companies building 5G networks using Chinese equipment often develop long term relationships with Chinese suppliers, potentially influencing future technology choices and creating dependencies. The equipment market also drives innovation cycles, as leading suppliers influence global technology directions.

European companies Ericsson and Nokia remain significant competitors with 24% and 20% market share respectively, but the combined Chinese position represents the largest single national bloc in the global market. Samsung of South Korea holds 12%, while US companies have minimal presence in the global 5G equipment market.

Strategic Approaches and Models

The fundamental difference between Chinese and American approaches to 5G development reflects broader philosophical differences about technology development and state involvement in strategic industries.

China employs a state driven coordination model with centralized massive investment focused on infrastructure quantity and domestic market development. The government treats 5G as a national priority, coordinating between state owned enterprises and private companies to achieve rapid deployment. This approach emphasizes technology sovereignty and positions 5G infrastructure as a foundation for broader economic development.

The United States relies on private sector leadership with market based competition driving innovation and deployment. American strategy focuses on innovation and applications rather than pure infrastructure numbers, emphasizing enterprise solutions and allied partnerships. The approach prioritizes supply chain security and leverages international cooperation to compete with Chinese state directed efforts.

These different models produce distinct advantages and challenges. Chinese state coordination enables rapid, large scale deployment but may sacrifice innovation efficiency. American market driven approaches foster innovation and flexibility but may struggle to match the scale and speed of coordinated state investment.

Timeline of Competition

The evolution of the 5G race reveals accelerating competition and diverging strategies over the past five years.

Both countries launched commercial 5G services in 2019, but their paths diverged dramatically afterward. China prioritized infrastructure development as a national economic strategy, treating 5G buildout as economic stimulus during the COVID pandemic. The United States focused on spectrum allocation and regulatory framework development, preparing for private sector led deployment.

By 2021, the competitive dynamics had shifted decisively. China controlled 70% of global 5G base stations while the United States achieved nationwide coverage through different technological approaches. China emphasized dense urban deployment while the United States prioritized broad geographic coverage.

The timeline shows China maintaining consistent infrastructure growth while the United States evolved toward enterprise applications and fixed wireless access services. These different trajectories reflect the strategic choices each country made about 5G development priorities.

Competitive Dynamics and National Security

The 5G race extends beyond commercial competition into national security considerations for both countries. The United States has implemented restrictions on Chinese equipment suppliers, citing security concerns about potential surveillance capabilities and supply chain vulnerabilities. These measures aim to prevent Chinese companies from gaining access to critical American telecommunications infrastructure.

China responds by emphasizing technology sovereignty and reducing dependence on American semiconductor technology. The country has accelerated domestic innovation programs and increased investment in alternative supply chains. This dynamic creates parallel technology ecosystems with limited interconnection.

The security dimension adds complexity to commercial competition, as countries must balance technological advantages against security considerations. Allied countries face pressure to choose between Chinese cost advantages and American security frameworks, fragmenting the global market.

Economic Impact and Future Implications

The economic implications of 5G leadership extend far beyond telecommunications revenues. Mobile technologies are projected to contribute $2 trillion or 8.3% of China's GDP by 2030, driven largely by 5G enabled applications and services. The manufacturing sector alone is expected to account for 40% of this economic impact.

For the United States, 5G deployment is expected to add $1.5 trillion to the economy and create 4.5 million new jobs. However, realizing these benefits depends on successful deployment and application development, areas where Chinese infrastructure advantages may provide competitive benefits.

The winner of the 5G race may gain sustained advantages in emerging technologies like artificial intelligence, Internet of Things, and autonomous systems that depend on advanced wireless connectivity. This creates incentives for continued intensive competition and investment.

Key Findings and Strategic Assessment

The 5G race reveals a complex competitive landscape where China has achieved clear infrastructure leadership while the United States maintains advantages in innovation and market development. China's state driven approach has produced remarkable deployment speed and scale, creating the world's largest 5G network infrastructure.

However, infrastructure alone does not determine ultimate success. The United States focus on applications, enterprise solutions, and international partnerships may prove more valuable for long term economic benefits. The competition reflects different national strategies and capabilities rather than simple technological superiority.

Personal Tiger’s take:

Both countries face significant challenges ahead. China must demonstrate that massive infrastructure investment translates into economic returns and technological advancement. The United States must prove that market driven innovation can compete effectively with state coordinated development programs.

The 5G race will likely continue for the remainder of the decade.

References

Brookings Institution: Navigating the US-China 5G competition

China Metal Network: China to ramp up 5G network construction to revive economy

Digital Watch Observatory: US National Strategy to Secure 5G

University of Nebraska: U.S. 5G Technology Policy: Competition or Boycott?

Xinhua Silk Road: China on fast track for new round of 5G construction

CISA: 5G Strategy - Ensuring the Security and Resilience of 5G

Atlantic Council: Forging the 5G future: Strategic imperatives for the US and its allies

PMI: China's Net Gain

Trump White House Archives: National Strategy to Secure 5G

Total Telecom: Connected America 2025: Is there a US-China 5G rollout race?

RCR Wireless: China to construct over 4.5 million 5G base stations in 2025

GovInfo: National Strategy to Secure 5G Implementation Plan

GIS Reports: USA-China: 5G race has enormous geopolitical implications

China Government: China makes big investments in 5G

Department of Defense: DoD 5G Strategy

RF Benchmark: Why China Is Winning the 5G Race

RCR Wireless: China to invest $134-223 billion in 5G networks during 2020-2025

NTIA: National Strategy to Secure 5G Implementation Plan

Brookings Institution: Navigating the U.S.-China 5G competition